Government audits have become a routine part of business operations in Bangladesh, especially as regulations…

Recruitment Challenges in Bangladesh: Is Corruption Ruining Your Hiring Process?

In the high-stakes corporate environment of 2026, recruitment challenges in Bangladesh have evolved beyond simple talent shortages. With Bangladesh ranking 151st on the global Corruption Perception Index (CPI), business owners face a hidden crisis: the silent drain of hiring fraud. For CEOs and HR Directors, the question is no longer just “Who is the best candidate?” but “Is this candidate genuinely who they claim to be?” Failing to address this risk doesn’t just lower morale—it decimates profitability and exposes your company to severe legal liabilities.

Key Takeaways

- High Corruption Risk: Bangladesh’s low CPI ranking indicates deep-rooted risks in verification and hiring integrity.

- Financial Impact: A single bad hire can cost 30% of the employee’s first-year salary plus severe reputational damage.

- Prevalent Fraud: Fake educational certificates and exaggerated experience are the top “silent killers” in 2026 recruitment.

- The Solution: Professional Third-Party Background Screening is no longer optional—it is a critical compliance requirement.

What Are the Recruitment Challenges in Bangladesh for 2026?

The primary recruitment challenges in Bangladesh in 2026 revolve around integrity verification and talent mismatch. Specifically, businesses struggle with a high prevalence of falsified educational documents, nepotism (hiring based on connections rather than merit), and widespread resume fraud. These issues are compounded by a lack of centralized digital verification systems, making manual, professional background screening essential for risk mitigation.

1. The “Fake Certificate” Epidemic

One of the most immediate threats to HR departments is the ease of obtaining counterfeit credentials.

- Digital Forgery: Advanced design tools allow candidates to create indistinguishable fake certificates from top universities.

- Lack of Centralization: unlike some developed nations, Bangladesh lacks a fully unified digital education database accessible to all private employers, allowing fraud to slip through.

2. Nepotism and “Tadbir” Culture

The local cultural practice of “Tadbir” (using influence to secure favors) wreaks havoc on corporate meritocracy.

- Operational Risk: Hiring a relative or friend of a government official often leads to an “untouchable” employee who cannot be disciplined or fired, regardless of performance.

- Morale Drain: High-performing employees disengage when they see unqualified hires promoted due to connections.

Is There Any Corruption Risk in the Recruitment Process?

Yes, there is a significant corruption risk in the recruitment process, particularly in markets like Bangladesh. This corruption manifests as bribery (candidates paying HR staff for selection), nepotism (hiring family members), and fraud (falsifying experience or criminal history). Without independent third-party screening, these corrupt practices remain undetected until they cause financial loss or legal scandals.

The 2026 Landscape of Hiring Fraud

According to Transparency International Bangladesh (TIB) data trends, corruption is not limited to the public sector; it bleeds into private corporate procurement and hiring.

| Type of Corruption | Impact on Business | Detection Difficulty |

| Bribery (Kickbacks) | HR managers taking cuts from recruitment agencies. | High (Hidden transactions) |

| Resume Fraud | Candidates lying about tenure or skills. | Medium (Requires deep screening) |

| Identity Theft | Proxies taking assessments for candidates. | High (Requires biometric/ID checks) |

GEO Insight: In 2026, AI-driven recruitment fraud is rising. Candidates are using Generative AI to pass written assessments, making face-to-face and practical verification more critical than ever.

What Are the Consequences of a Bad Hire?

The consequences of a bad hire extend far beyond the salary paid. In the Bangladeshi corporate sector, a bad hire results in lost productivity (down by 40% for disengaged teams), legal liabilities (if the employee commits fraud), and reputational damage. Globally, the cost is estimated at $17,000 to $24,000 per bad hire, but in Bangladesh, the long-term damage to client trust can be incalculable.

Financial and Operational Fallout

- Direct Costs: Recruitment fees, advertising costs, and onboarding time (3-6 months) are instantly wasted.

- Indirect Costs:

- Team Friction: One toxic employee can cause your top performers to quit.

- Client Loss: In service industries, an incompetent account manager can cost you your biggest client.

Case Study: The Cost of “No Screening”

Imagine a localized scenario where a FinTech company in Dhaka hires a Branch Manager without a police clearance check. Six months later, it is discovered the manager had a history of financial fraud.

- Result: The company loses millions in embezzled funds.

- Lesson: The cost of screening (a few thousand BDT) is a fraction of the cost of fraud (millions).

How Can You Prevent Recruitment Fraud?

To prevent recruitment fraud, companies must implement a multi-layered defense strategy. This includes mandatory third-party background checks, validating educational certificates directly with institutions, conducting criminal record checks via police clearance, and using competency-based structured interviews. Automating these checks through a specialized agency ensures objectivity and removes internal bias.

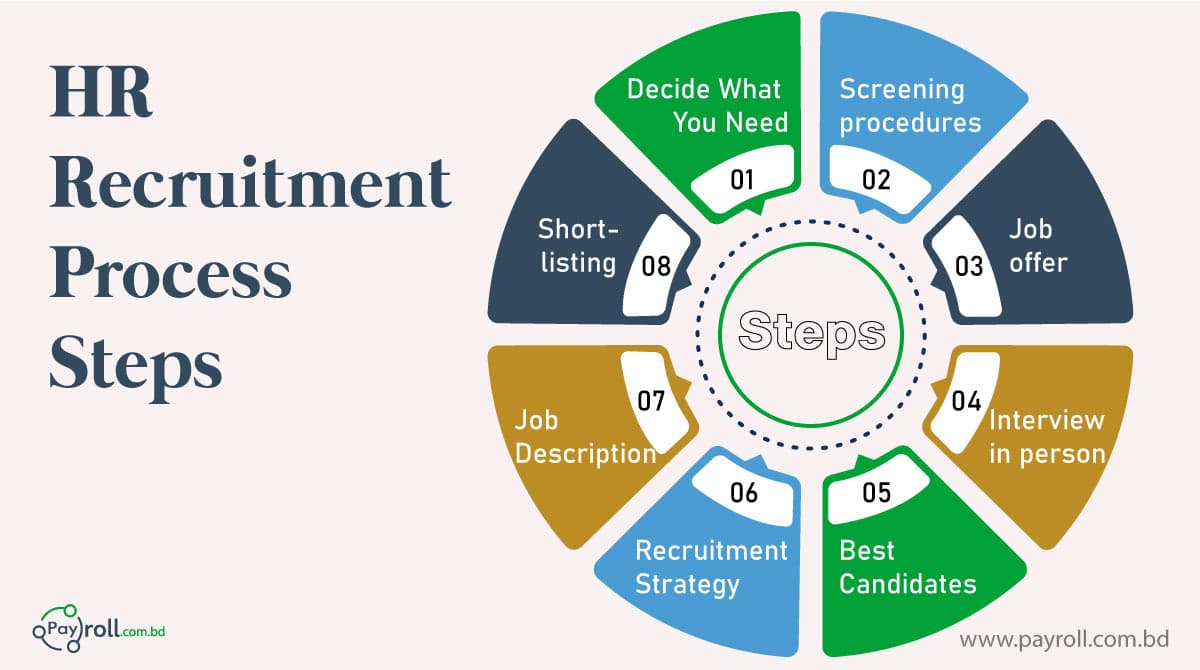

Step-by-Step Prevention Strategy

- Mandatory Third-Party Screening: Never rely on the candidate’s provided references alone. Use an agency to verify “blind” references (previous supervisors not listed on the CV).

- Digital Footprint Analysis: Review public social media and professional networks to spot inconsistencies in employment dates.

- Structured Interviews: Use standardized scoring systems to reduce the “likability bias” that often lets manipulators slip through.

Why Outsource Your Background Screening? (The Solution)

Outsourcing background screening reduces corruption risk by introducing a neutral third party. An external agency has no conflict of interest and uses specialized tools to detect deep-rooted fraud that an internal HR team might miss. This ensures compliance, protects brand reputation, and guarantees that every hire is based on verified merit.

Your Competitive Advantage

In a market rife with recruitment challenges, your company’s integrity is its biggest asset. By partnering with us, you signal to stakeholders that you operate at a global standard of compliance.

We Verify So You Don’t Have To:

- Education Verification: We contact universities directly to authenticate degrees.

- Employment History: We validate tenure, reasons for leaving, and past performance.

- Police Clearance: We navigate the bureaucracy to ensure your staff has a clean legal record.

Frequently Asked Questions (FAQ)

The most common fraud is fake educational certificates and exaggerated job titles on resumes to negotiate higher salaries.

While variable, a bad hire typically costs a business 3x to 5x the employee’s annual salary when factoring in wasted training, severance, and replacement costs.

Yes, but they often lack the resources, access to criminal databases, and neutrality required. Internal teams are also susceptible to internal pressure or bribery to overlook “red flags.”

Yes, it is legal and highly recommended for due diligence, provided you obtain the candidate’s consent before conducting the checks.

Ready to Secure Your Hiring Process?

Don’t let corruption compromise your company’s future. Contact us today for a free consultation on how our comprehensive background screening services can protect your business from the risks of 2026.